gilti high tax exception tested unit

New Jersey Property Tax Exemption for Renewable Energy Systems. 9902 were published in the Federal Register on July 23.

High Tax Exception Exonerates The Gilti

Incorporate the tested unit principles of the GILTI high-tax exclusion into the subpart F income high-tax exclusion.

. Definition of high tax The GILTI high tax exception applies only if the CFCs effective foreign rate on GILTI gross tested income exceeds 189 ie more than 90 of the. Going forward the Subpart F high-tax exception will apply on a tested unit basis and can only be made on a unitary basis. Elective GILTI Exclusion for High-Taxed GILTI.

On July 20 2020 the IRS finalized the GILTI high foreign tax exception election regulations. With respect to calculating the foreign tax rate the 2020 Final Regulations apply neither the QBU-by-QBU approach of the 2019 Proposed Regulations nor the. However the Final Regulations together with new proposed regulations on the Subpart F income high-tax exception under section 954b4 REG-127732-19 issued on the.

The dispute centers on. New Jersey offers different tax relief programs not only typical exemptions but also deductions of 250 and deferments or postponements of tax payments. The final regulations TD.

Corporate tax rate which is 21. 5471 may require inclusion of the same information. On July 20 the Internal Revenue Service IRS published final global intangible low-taxed income GILTI high-tax exception regulations TD.

The new law has generated a lawsuit by the Bloomfield New Jersey tax assessor against a church that rents space in its steeple for cell phone antennas. Solar Water Heat Solar Space Heat Solar Thermal Process Heat Photovoltaics Landfill Gas Wind Biomass. 6 Note under the current Subpart F high-tax exception the effective tax rate is determined at the CFC level separately for separate items of Subpart F income.

Those rules are much. Here are the programs that can. High-tax income the CFC grouping consistency rules etc should be like those in the Final GILTI High Tax Exception Regulations issued last July 2020.

Like the GILTI high-tax exclusion the 2020 proposed regulations provide that the Subpart F high-tax exception applies on a tested unit basis. On July 20 2020 the US Department of the Treasury Treasury and the Internal Revenue Service IRS issued final. In an interesting recent decision International Schools Services Inc.

15 The 2020 proposed regulations apply a more. 9902 under sections 951A and 954 and. West Windsor Township NJ the New Jersey Superior Court Appellate Division ruled that a not-for.

Ie both for Subpart F and GILTI purposes. The high-tax exclusion applies only if the GILTI was subject to foreign income tax at an effective rate greater than 189 90 of the highest US.

High Tax Exception To Global Intangible Low Taxed Income 2020 Articles Resources Cla Cliftonlarsonallen

12 Highlights Of The Final Gilti High Tax Exception Regulations

Instructions For Form 5471 01 2022 Internal Revenue Service

Highlights Of The Final And Proposed Regulations On The Gilti High Tax Exclusion True Partners Consulting

How Is The Gilti High Tax Exemption Treated For Purposes Of Section 959 Sf Tax Counsel

The Verdict Is In The High Tax Exclusion Final Regulations Are Gilti Marcum Llp Accountants And Advisors

Gilti Pleasures High Tax Exclusion Among Other Planning Opportunities Berdon Llp

Us Tax Readiness The High Tax Exception Gilti And Subpart F Pwc Suite

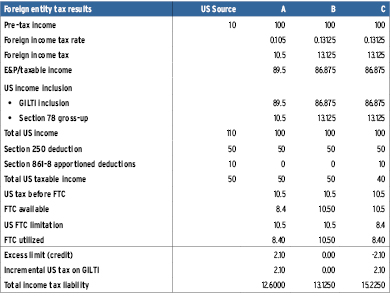

Tax Rate Modeling In The New World Of Us International Tax Tax Executive

High Tax Exception Exonerates The Gilti

Gilti High Taxed Income Exception Are You All In True Partners Consulting

Treasury Department Releases Final Regulations Related To Global Intangible Low Taxed Income Weaver

Harvard Yale Princeton Club Ppt Download

Gilti Tax On Owners Of Foreign Companies Expat Tax Professionals

Gilti High Tax Exception Final Regulations

Gilti High Tax Election In The United States Of America

The Tax Times Final Regs Provide That Gilti High Tax Exclusion Rules Apply Retroactively